Should You Lock in Your Mortgage Rate Now or Wait? Expert Advice

Buying a home or refinancing your mortgage involves one of the most critical financial decisions you'll ever make — and mortgage rates are at the center of it. A common question among borrowers is: Should I lock in my mortgage rate now or wait? The answer depends on several personal, economic, and market-related factors. In this article, we’ll break down what you need to consider and provide expert tips to help you make a smart, informed decision.

Understanding Mortgage Rate Locks

A mortgage rate lock is a lender’s commitment to hold a specific interest rate for you for a set period, typically ranging from 30 to 60 days. This can protect you from rate increases before your loan closes.

Benefits of Locking In Your Rate:

- Protection from future rate hikes

- Peace of mind during the home-buying process

- More accurate monthly budgeting

Risks of Locking Too Soon:

- You might miss out on potential rate drops

- Extensions can cost extra

- Locks are only valid for a specific period

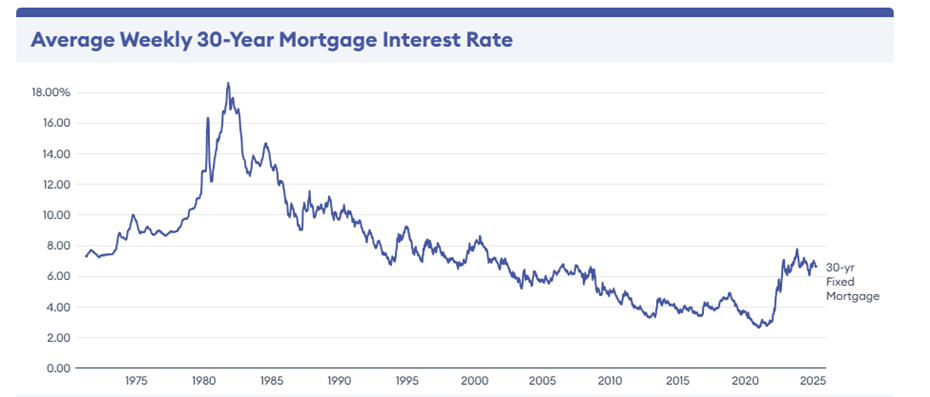

Current Market Trends in Mortgage Rates (As of 2025)

Mortgage rates have seen fluctuations in recent months due to inflation, Federal Reserve policy shifts, and global economic uncertainties. While they’re not at historic highs, rates are still above pandemic-era lows, leaving many buyers in a dilemma.

Key Influences on Mortgage Rates:

- Federal Reserve interest rate policy

- Inflation and employment reports

- Housing market demand and inventory

- Geopolitical events impacting economic stability

When It Makes Sense to Lock Your Rate

Locking your rate now might be the better choice if:

- You're buying in a competitive housing market

- Your closing date is near

- Rates are trending upward

- You have a tight budget that depends on current rates

Experts recommend locking when you have a signed purchase agreement and a set closing date.

When Waiting Might Be Better

You might choose to wait if:

- The market shows a trend of falling rates

- You're still shopping for a home

- You’re months away from closing

- You can tolerate some risk for potential savings

However, timing the market is notoriously difficult — even for professionals.

Tools to Monitor Mortgage Rate Movements

Using the right tools can help you make a data-driven decision. Consider:

- Mortgage rate tracking apps

- Newsletters from mortgage brokers

- Alerts from financial news sites

- Economic reports on inflation and job markets

Expert Tips to Navigate Rate Fluctuations

Here are some actionable tips to help you manage the volatility:

1. Stay in Touch With Your Lender

Your lender can provide real-time updates and guidance tailored to your situation.

2. Consider a Float-Down Option

Some lenders offer this as a compromise — you lock your rate, but if rates fall significantly, you can still benefit.

3. Understand Rate Lock Periods

Make sure your rate lock covers the time until your closing date. If not, you may face fees or lose your locked rate.

4. Use Scenario Planning

Run different mortgage scenarios with your lender. Know how a 0.25% rate increase or decrease would affect your payments.

5. Work With a Mortgage Broker

Brokers have access to multiple lenders and can help you find the most flexible locking terms.

Common Misconceptions About Mortgage Rate Locks

Myth 1: Locking Always Costs Money

Many lenders offer free rate locks for a standard period. Fees usually apply only when extending or modifying the lock.

Myth 2: Rates Always Fall After You Lock

This is a classic case of buyer’s remorse. Rates can move either way, and locking provides certainty.

Myth 3: You Can’t Change Lenders After Locking

You’re not always stuck with the lender if you find a better deal — though switching might delay your closing.

Tips for First-Time Homebuyers

- Prioritize stability over minor savings — predictability matters when budgeting

- Don’t stress about locking at the lowest rate ever — aim for one that fits your financial plan

- Avoid making assumptions based on short-term rate changes

Lock Strategy for Refinancers

If you're refinancing, locking in a low rate can help you calculate your breakeven point more accurately and determine when the refinance will start saving you money.

Advice for Investors or Second Home Buyers

Since investment properties often have higher interest rates, timing the market could have a larger financial impact. Still, locking early may help reduce unpredictability in your cash flow models.

The Role of Inflation and the Fed

The Federal Reserve’s stance on inflation plays a huge role in interest rates. If inflation remains high, the Fed may continue rate hikes — making early locking more advantageous.

What Experts Say: Should You Lock Now or Wait?

Mortgage analysts suggest locking if you:

- Need financial certainty

- Are sensitive to monthly payment fluctuations

- Are closing within the next 45 days

Waiting might work if:

- You’re still house hunting

- You follow rate trends closely

- Your lender allows flexible terms or float-down options

Conclusion

Locking in a mortgage rate is a strategic decision that balances risk tolerance, market timing, and personal financial goals. If you need peace of mind and budget stability, locking in now is often the wiser move. But if you have flexibility and are willing to watch the market, waiting could pay off — especially if trends suggest falling rates. The best choice is the one that aligns with your individual circumstances and long-term financial well-being.Stay informed, work with trusted professionals, and use the tools at your disposal. In the ever-changing world of mortgage rates, being proactive is your best strategy.

FAQs

1. What does it mean to lock in a mortgage rate?

It means securing a specific interest rate for a set time, protecting you from potential rate hikes.

2. Can I change my lender after locking a rate?

Yes, but it may involve delays or require restarting some parts of the process.

3. How long should I lock my rate for?

Typically, rate locks last 30–60 days. Choose a period that comfortably covers your expected closing timeline.

4. What is a float-down option?

A float-down option allows you to benefit from rate drops even after locking — usually under specific conditions.

5. Is it better to lock during pre-approval or after making an offer?

It’s usually better to lock after your offer is accepted and your closing date is confirmed.

For more inspiration and to connect with people who believe in big dreams, visit us online at KirkandStacy.com.

Ready to explore all the Gulf Coast lifestyle has to offer? Call or text us today—we’d love to share what makes it so special here and help you find your perfect piece of paradise!

Click here to save our contact info: https://dot.cards/kirkweingarten

Categories

Recent Posts

Contact Us Today

Real Estate Expert | License ID: SL3480387 ,SL347795 ,MA9510605

+1(941) 432-4141 | stacy.weingarten@joinreal.com